With the COVID-19 cases increasing by the day and the National Capital Region becoming locked down a quarantined community in the next few days, people are more scared to go out over fears of contracting the virus. We actually have a proposal: It’s the best time right now to go cashless in the Philippines.

We’re not forcing you to do this, but please take this as advice from someone who actually uses mobile wallets to go through day-to-day activities. I really want everyone to know how easy and safe it is to actually invest on at least one mobile wallet app for daily, monthly, or weekly use. Here’s what I really learned from using these apps in the past few years:

More than just being a wallet

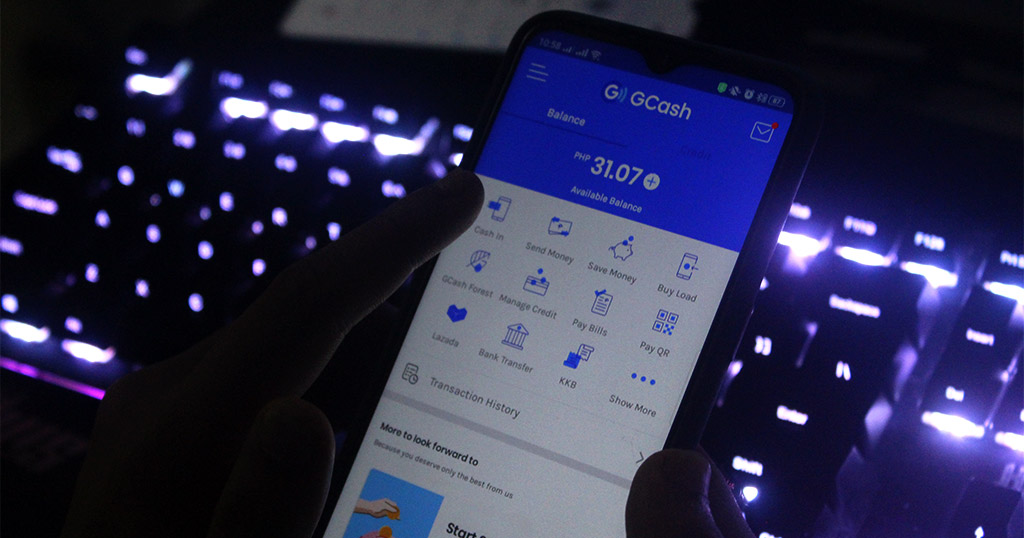

Here’s the fun fact: Mobile wallet apps have moved on from being just a placeholder for virtual money as they continuously expand their services. No need to go out to your suking tindahan or the nearest Bayad Center, because you can already do it in one app. Whenever my mom asks me to send her some prepaid load, I just do it with a tap. Some of them, including GCash, offer a physical card that can be linked to the account for instant withdrawals. It also provides other options such as saving up, investing, and donating to charitable causes.

The convenience of bank transfers

Having an app actually saves you time from spending too much hassle with bank apps and charges. I usually transfer my money from my bank account to one of my mobile wallet apps to use as funds for payment. I can also have the convenience of sending money over to someone using the same money app as I do or deposit them straight to their bank accounts.

No more lines, no more waiting times

The most convenient part of my cashless journey is being able to pay about almost anywhere, without having to go to a physical location and lining up for it. Paying for utility bills, postpaid plans, and even my credit cards all go through a mobile wallet app, and I have never encountered any issues so far. I also find it great that these partner companies acknowledge the date I actually paid for the bill, as it’s reflected in the next. No

Easier in-store payments. Period.

Lastly, the best perk of having these kinds of apps is the ability to check out about almost anywhere by just scanning QR codes. Enjoying my KFC meal? Scan to Pay with Gcash. Purchasing medicines at Watsons? Scan and go. Paying for my groceries at Puregold or 7-Eleven? Generate a bar code to pay. Even shopping for gadgets and appliances at Automatic Centre? You actually can do that with a phone.

There are more to mobile wallets nowadays. They have now evolved from being just mere virtual money wallets to super-apps with lots of functions to explore. The best part? I can do all of this without even going out of my home. We recommend using it not only in frightening times like this but also in instances where convenience is what matters most.

Discover more from WalasTech

Subscribe to get the latest posts sent to your email.

Get the latest from WALASTECH directly on your Google feed.

Add as a preferred source on Google

Leave a Reply